Table of Contents

ToggleIn February of 2023, Missouri rolled out recreational cannabis sales for the first time in the state, with sales taxes at 6%. However, a new Missouri marijuana tax proposal could make recreational cannabis significantly more expensive.

Compared to other states in the country, Missouri’s additional recreational sales tax of 6% wasn’t too hefty. Now, consumers in different cities and counties may be facing up to 12% in additional taxes when buying their favorite plant.

Today, we’re covering the details of this proposal, what it would mean for recreational consumers, and why having a medical card is still the best way to save money — and avoid these high tax spikes.

What Are the Current Missouri Marijuana Tax Regulations?

Missouri first legalized medical cannabis back in 2018, and medical marijuana cardholders have to pay 4% in sales tax for their products. This sales tax is pretty comparable to the rest of the medical states in the country (though some states don’t call for any sales tax for MMJ patients).

Recreational cannabis, on the other hand, wasn’t legalized in the Show-Me State until February of 2023. Immediately, sales exploded, and the state saw over $100 million in revenue just after the first month.

Those who don’t have medical marijuana cards have to pay an additional 6% in sales tax when buying their products. This means that adult-use weed will cost recreational consumers 2% more for the same product as a medical marijuana cardholder.

It’s worth noting that cities and counties do have the option of imposing an additional 3% county/city tax on top of the 6% sales tax for recreational consumers. So, some places may be even more expensive than others to buy your adult-use products.

However, those numbers may be changing soon as Missouri marijuana tax laws continue to be debated.

Missouri Marijuana Taxes: What Might Change?

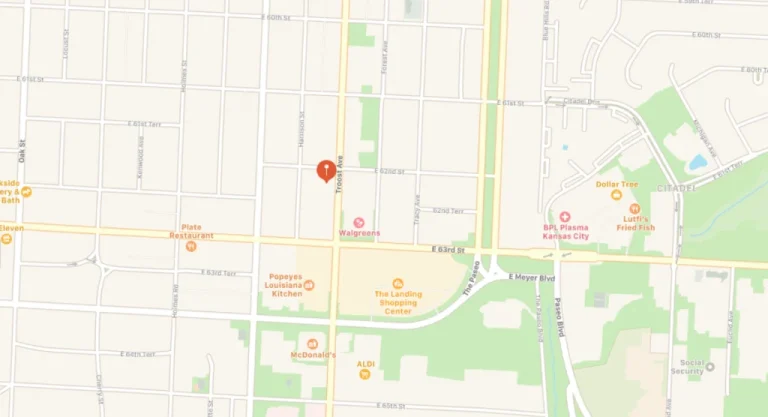

Recently, state officials in St. Louis, Jackson, and St. Charles have shown interest in stacking both county and city taxes on top of sales taxes for recreational cannabis.

Initially, the regulations stated that counties could impose these additional taxes on unincorporated areas, and cities could impose them within their own borders. However, this didn’t call for the ability to implement both.

But, that’s exactly what many state officials are calling for in the April 4th election.

Residents will be asked to vote whether or not they agree to this new hike in recreational cannabis taxes, potentially doubling the amount of taxes adult-use consumers pay for their products.

This would mean that recreational consumers would pay 6% in sales tax, and then potentially an additional 3-6% in county and city taxes for their weed.

How Does This Impact Recreational Consumers? (And Medical Cardholders?)

So, how does this new Missouri marijuana tax proposal affect recreational consumers? Well, they’re going to have to pay a lot more for their cannabis.

3-6% in taxes may not seem like a lot. But, when you add it to the already-existing 6% in sales tax, that brings your total to anywhere from 9-12% more than it would be without the taxes.

This means that when recreational consumers buy their products, they can expect to pay more than what they used to for the same product just a few weeks ago if this vote passes.

The good news here is for medical patients: this new proposal will not affect you.

Medical marijuana cardholders are not going to be subjected to these additional city and county taxes. Instead, cardholders will stay paying just 4% sales tax for their products.

Simply put, the new Missouri marijuana tax proposal is only for recreational purchases. If you have a medical card, you’re saving money every time you buy.

The Ever-Present Benefits of Having a Missouri Medical Marijuana Card

Even before recreational cannabis went legal, Elevate Holistics has stressed the various benefits that come with having a Missouri medical marijuana card. And now, the benefits just keep becoming more apparent.

At first glance, people get turned off by the fact that you have to buy a medical card and pay for a doctor’s appointment.

However, with the money you save on taxes — as well as dispensary discounts for cardholders — your card pays for itself within your first few purchases.

As we’ve mentioned, Missouri marijuana tax regulations are very low for cardholders. Medical patients pay 4% only, while recreational consumers pay 6% — and could be paying up to 12% really soon.

In most dispensaries, you will also receive an additional discount just for having your medical card.

Oh, and don’t forget that having an MO MMJ card means priority service, including having access to cannabis delivery.

And this is just the start! If you want to learn more about the benefits of getting your medical card in Missouri, just click here.

Get Your MO MMJ Card and Avoid High Missouri Marijuana Tax Regulations

The best way to avoid Missouri marijuana tax hikes is to get your hands on an MMJ card. And with Elevate Hoilstics, the process has never been easier.

With our telehealth platform, you’ll chat over the phone or computer with one of our expert physicians. During this time, our MMJ doctor will determine whether or not you qualify for medical cannabis in MO.

If you do, we’ll get you your recommendation straight away, and do the state registration process for you. This way, the only thing you have to do is show up to your appointment and pay the state fee.

If you’re interested in experiencing the benefits of Missouri medical cannabis firsthand — and want to save some money on purchases — you can book an appointment with us today.

Don’t forget to purchase our Priority Full-Service add-on so we can register you with the state and handle all the hard work for you.

Click here or the button below to book an appointment today.